EAGLE EYE

MODEL

PORTFOLIO

WHAT IS EAGLE EYE?

Eagle Eye is an IPP Financial Advisers Pte Ltd in-house proprietary Model Portfolios, reflecting the investment views and strategy of IPPFA’s Investment Team.

Eagle Eye conducts portfolio rebalancing, involving the buying, selling or switching of funds in the portfolio at specific time frames, so that the funds remain allocated according to the risk allocations. Eagle Eye not only schedules quarterly rebalancing, but may also conduct ad-hoc rebalancing to react to dynamic market conditions.

OUR INVESTMENT STRATEGY

IPPFA’s Investment Team employs a systematic approach in developing its investment strategy and utilises proprietary FTQ methodology to determine asset allocation.

FUNDAMENTAL

We assess the economic conditions and market sentiments and perform a fundamental valuation of all major markets.

TECHNICAL

We use our proprietary technical indicators and other relevant technical analysis tools to identify price patterns and market trends.

QUANTITATIVE

We anticipate stock market movements through our proprietary Statistical Research Model.

*This advertisement has not been reviewed by the Monetary Authority of Singapore.

invest based on your risk profile

Eagle Eye’s

Track Record

Eagle Eye has four risk profiles, namely Conservative, Moderate, Aggressive and Very Aggressive to cater to the different investment objectives, risk profiles and needs of clients. Eagle Eye’s performance since its inception in January 2015 has been remarkable. Its various risk portfolios have outperformed their corresponding benchmarks – a feat that is extremely difficult to accomplish.

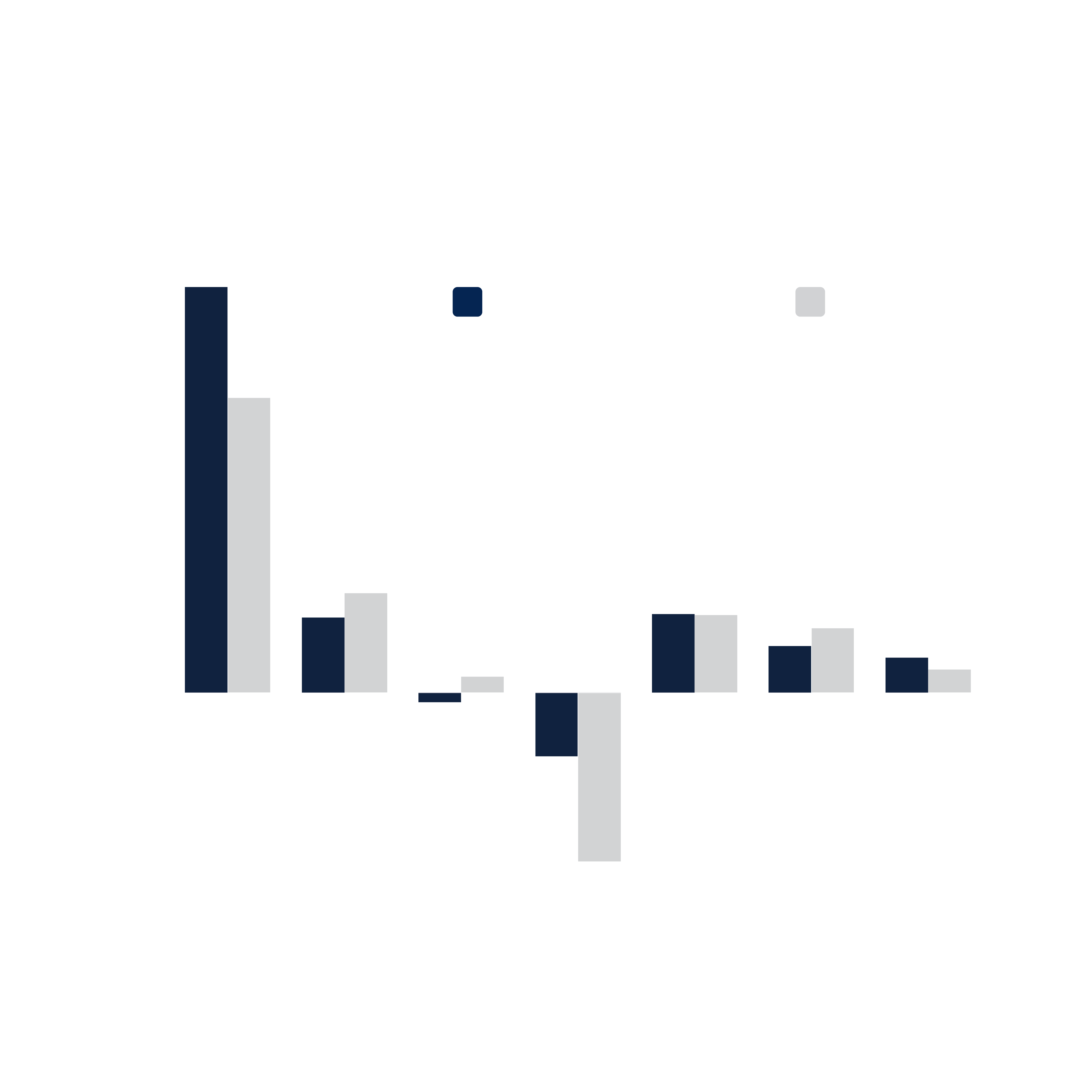

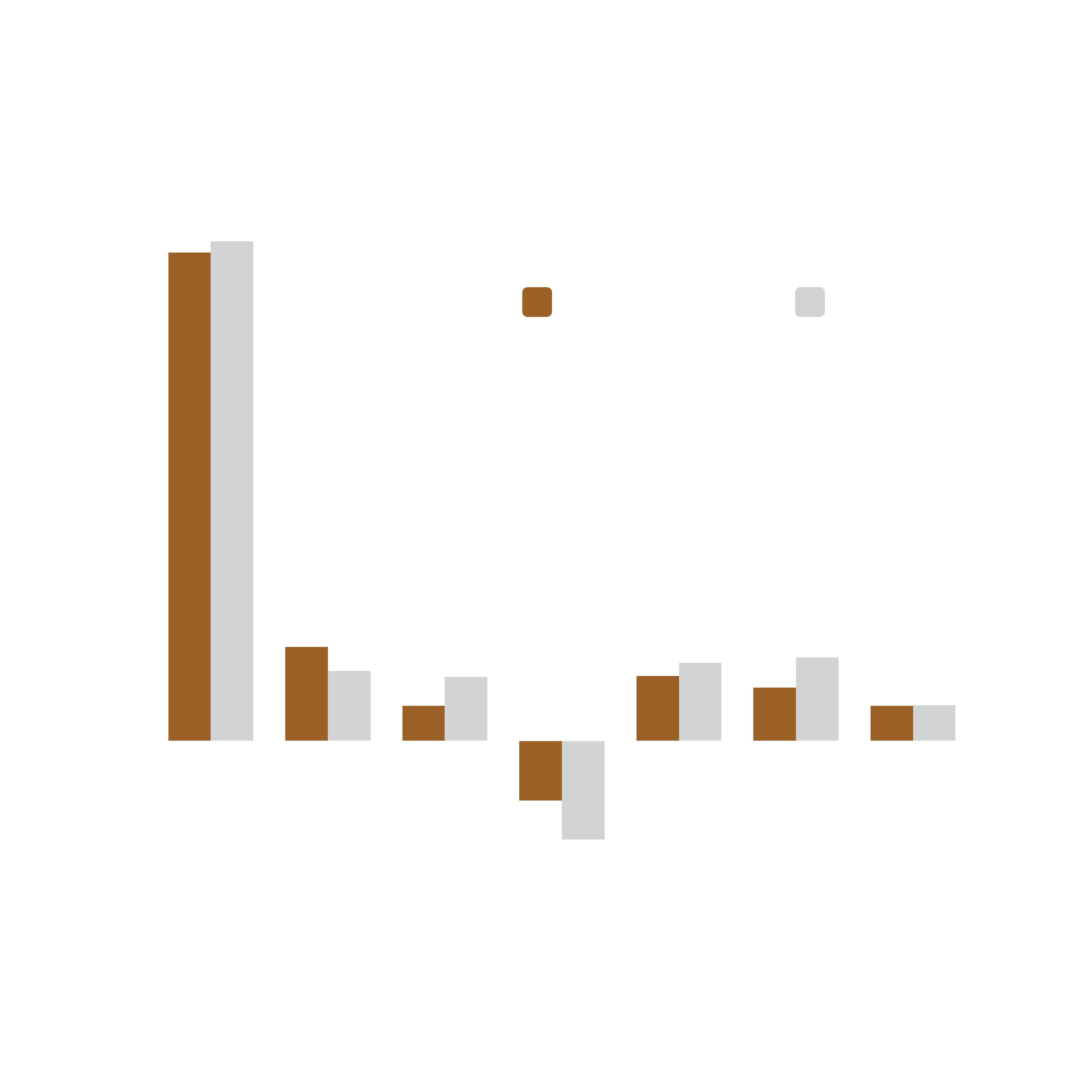

CONSERVATIVE

For the Conservative portfolio, the target annualised return is 3% to 4%.

Performance of Model Portfolio (2015-2024)

The flagship Eagle Eye Dynamic Conservative (Cash) portfolio has returned 38.50% since inception, compared to 27.50% for its

corresponding benchmark.

*Before advisory and platform charges

**Data as of 31 Mar 2025

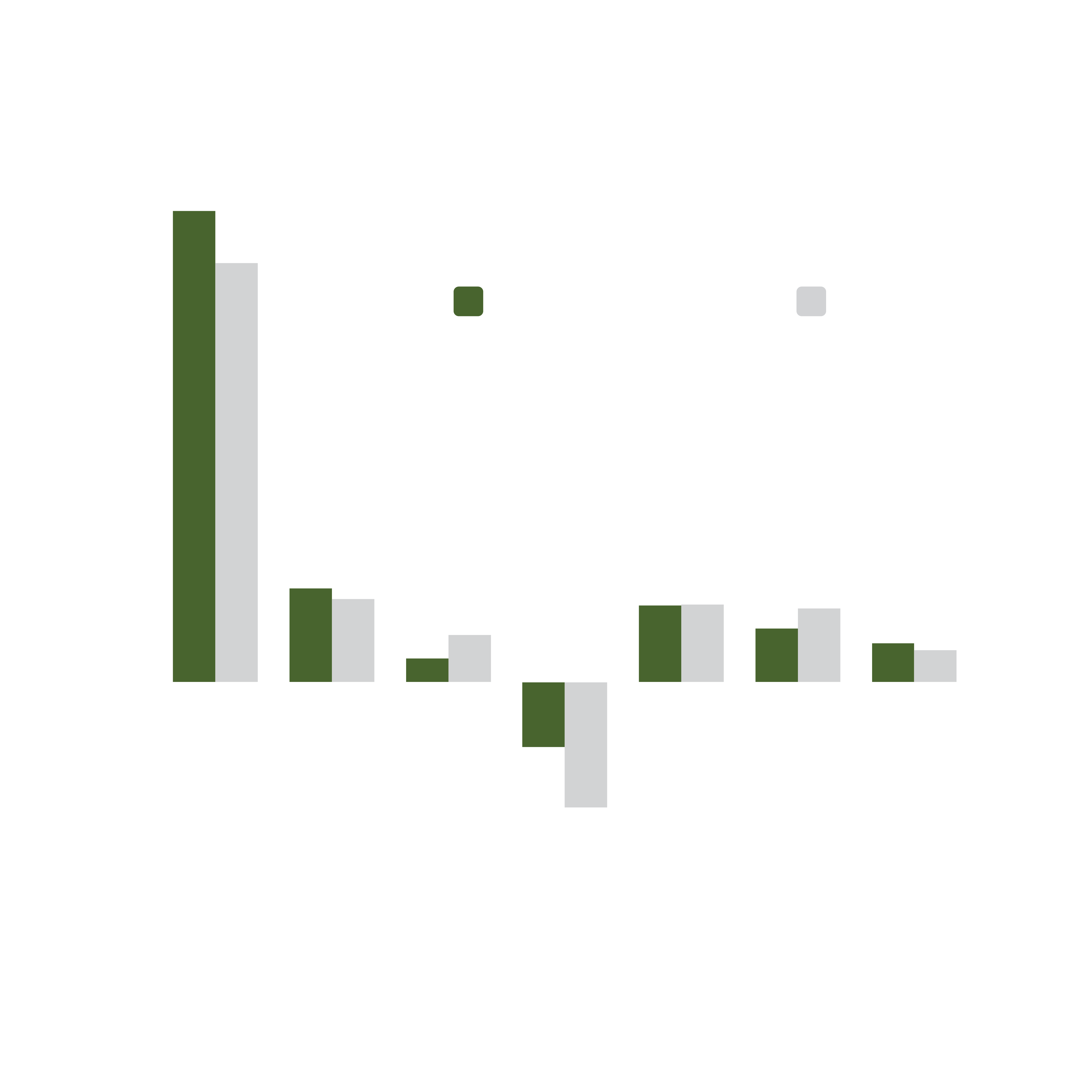

MODERATE

For the Moderate portfolio, the target annualised return is 5% to 6%.

Performance of Model Portfolio (2015-2024)

The flagship Eagle Eye Dynamic Moderate (Cash) portfolio has returned 62.80% since inception, compared to 55.20% for its corresponding benchmark.”

*Before advisory and platform charges

**Data as of 31 Mar 2025

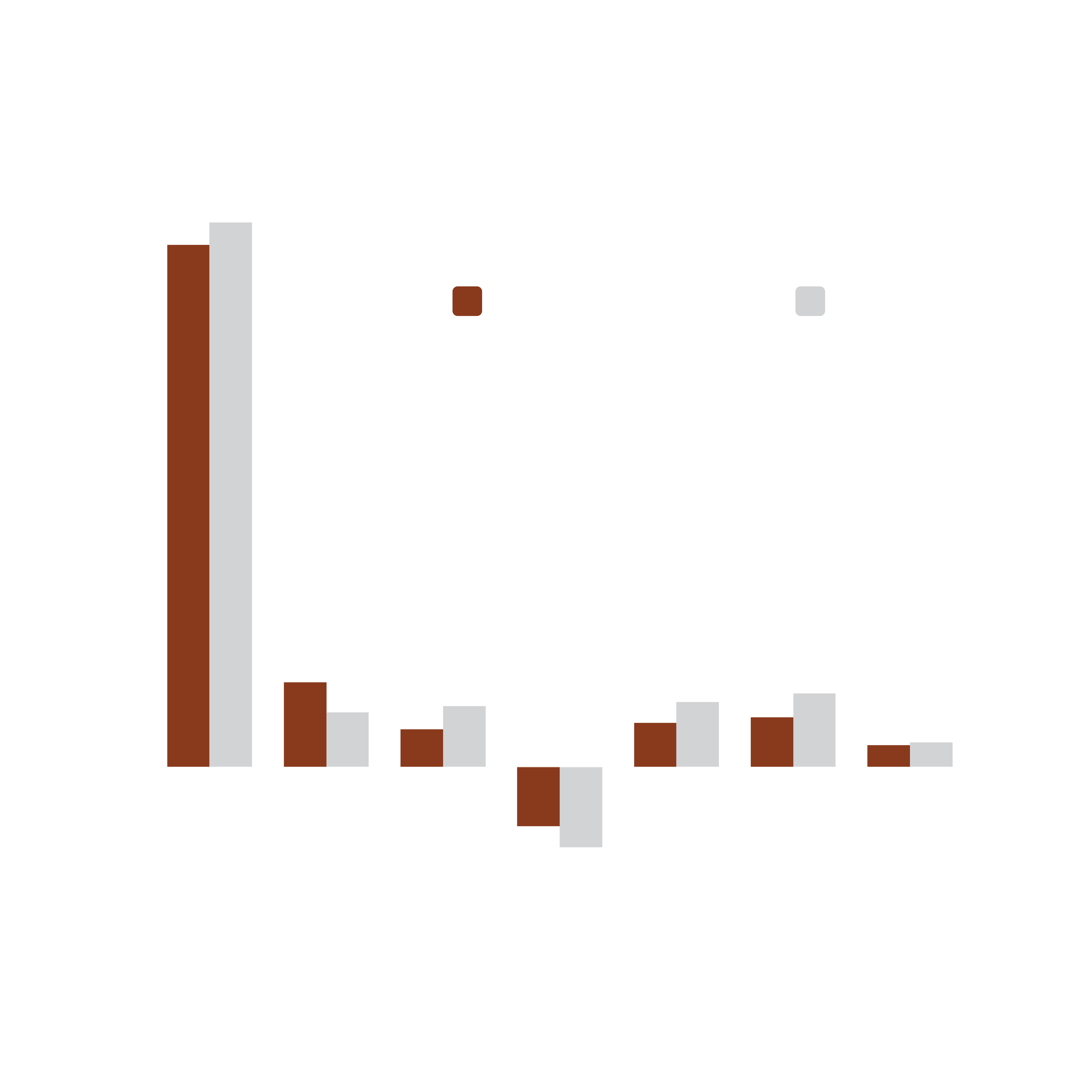

AGGRESSIVE

For the Aggressive portfolio, the target annualised return is 6% to 7%.

PERFORMANCE OF MODEL PORTFOLIO (2015-2024)

The flagship Eagle Eye Dynamic Aggressive (Cash) portfolio has returned 85.50% since inception, compared to 87.10% for its corresponding benchmark.

*Before advisory and platform charges

**Data as of 31 Mar 2024

VERY AGGRESSIVE

For the Very Aggressive portfolio, the target annualised return is 7% to 8%.

ERFORMANCE OF MODEL PORTFOLIO (2015-2024)

The flagship Eagle Eye Dynamic Very Aggressive (Cash) portfolio has returned 119.10% since inception, compared to 123.20% for its corresponding benchmark.”

*Before advisory and platform charges

**Data as of 31 Mar 2025

Investment products are subject to investment risks including the possible loss of the principal amount invested. The performance of an investment product is not guaranteed and the value of the investment product may fall or rise. Past performance of investment products is not necessarily indicative of their future performance. You may wish to seek advice from a financial adviser before making a commitment to purchase the product. In the event that you choose not to seek advice from a financial adviser, you should consider whether the product in question is suitable for you.