4 Questions To Ask Yourself When Planning For Retirement

You may be midway into your career, but retirement is no longer just an idea that’s far ahead into the future. It is the start of a new phase with new exciting opportunities ahead.

That is why planning for retirement is an integral part of any comprehensive financial plan. Your decisions today can impact your financial security and quality of life for your golden years, so it is essential to seriously consider the factors that may be influencing the quality of your retirement.

Here are four simple questions to ask yourself.

When Do I Want To Retire?

There are “push” and “pull” factors when considering retirement. For example, push factors include the state of your health, work stress, or seeking a change of environment. Pull factors include the freedom to pursue activities you enjoy, travel, or even volunteer in a charity.

Yet, there has been a gradual shift from the traditional idea of retirement over the past decades. In 1990, 22.2% of Singapore residents aged 65 to 69 were still in the workforce. This number more than doubled to 48.7% in 2020.

The shift is attributed to a few reasons:

- We are living longer

- Our traditional family structures have changed

- Additional financial commitments with helping adult children or elderly parents

Today, Singapore employers are mandated to offer workers re-employment when they retire at 62, as long as they meet the eligibility criteria of re-employment. Social factors such as staying engaged aside, most of those aged 62 and above remain in the workforce due to financial reasons.

Planning early for your retirement allows you the freedom to decide your retirement age and give you more options when the time comes. The sooner you begin discussions with your family and financial adviser about what you want, the easier your retirement dreams can become a reality.

How Much Do I Need in Retirement?

Apart from your Central Provident Fund (CPF) account savings, where will your income come from? Now is as good as a time as any to re-evaluate your financial plans.

The most important question is whether you will have enough time and resources today to create income streams to support your desired quality of life after retirement.

So how much do you need? It all depends.

Ask yourself:

- What do I want to do?

- Where do I want to live?

- What kind of lifestyle do I want?

The answers can help you think of what percentage of your income you will require when you retire.

A good rule of thumb is to aim between 60% and 70% of your last drawn monthly income for your retirement expenses. For example, if you earn $10,000 per month prior to retirement, you should budget a retirement income of $7,000 per month.

You might also need to make adjustments based on the type of planned retirement and if your expenses will be significantly different. For example, would you plan to travel more after you retire? Or, if you intend to downsize your living situation, you may be able to live comfortably on less.

Do bear in mind that some expenses could go up in retirement. These may include utilities, travel, healthcare, and entertainment.

Consult a financial adviser who can assess where you stand and help you make any adjustments to help you retire the way you want.

How Long Must Your Retirement Nest Last?

Medical advances and improvements to primary healthcare have enabled people to live longer and better. Compared to a decade ago, the life expectancy of Singapore residents has increased by two years. In 2010, life expectancy was 81.7 years, while the age increased to 83.9 years in 2020.

With a longer life expectancy, it is essential to keep in mind the length of your retirement. Overestimating the length of your retirement ensures that you have enough but can make for an uncomfortable journey. On the flipside, underestimating the length of your retirement can leave you in an awkward situation during retirement.

A simple way to calculate how long your retirement nest must last:

Life expectancy – Desired retirement age = Years your retirement nest must last.

Example:

What is the Inflation Rate?

Many people plan for their future needs based on present-day costs. They fail to factor in inflation which can be a costly mistake.

Inflation measures the change in living costs over time. For many, the spending power of the income you have now will reduce because of inflation during your retirement as costs of goods and services rise. This can affect your standard of living and is especially problematic for retirees.

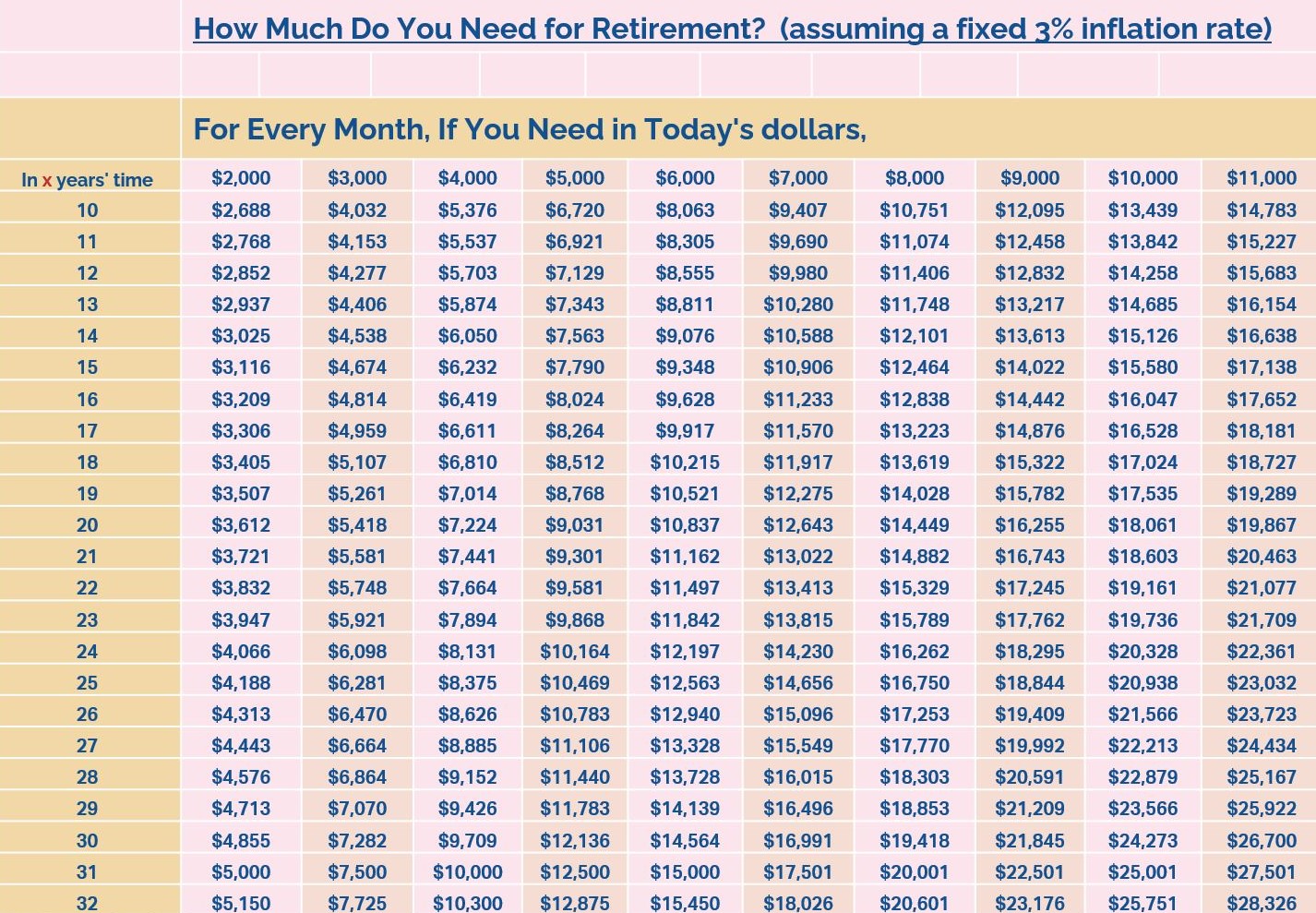

Based on the table above, assume that you are earning a monthly income of $5,000 today. By using a fixed 3% inflation rate, you would need a monthly income of $9,031 in 20 years to continue the lifestyle that you enjoy today.

To maintain your lifestyle in retirement, you need to make sure that your retirement income can keep up with inflation.

Do not leave your retirement to chance. It is vital to take an honest look at your current finances and determine your retirement goals and dreams. With the help of a financial adviser, you can find the best path to get from here to there.

Alex Ang, a well sought-after adviser in the financial planning industry, has more than a decade of experience in helping people achieve their financial goals. As a dedicated adviser, he has built an extensive network of long-term clients who appreciate his impeccable service and advice.

Based on his outstanding performance, Alex has received numerous awards such as the IPP Chairman’s Round Table and the IPP-APEX Top Adviser. He is also consistently ranked as one of the top 10 advisers in IPP since 2014.

Recognised for his leadership skills, Alex is known to be selfless as a mentor to his team and new advisers. Under his tutelage, these advisers too have achieved success within a short timeframe. Described as a kind and passionate leader, Alex is proficient in customising the learning program according to each of his mentee’s personality. By identifying their talents, he guides them patiently on how to utilise their skills to flourish in the industry. With numerous accolades under his belt, Alex’s next goal is to nurture the next generation of leaders in the financial planning industry.

Contact Alex Ang at:

Corporate E-mail:

alexang@ippfa.com

IPP Financial Advisers Pte Ltd

78 Shenton Way #30-01 Singapore 079120 | Tel: +65 6511 8888 | enquiry@ippfa.com |

IPP Financial Advisers Pte Ltd

78 Shenton Way #30-01 Singapore 079120

Tel: +65 6511 8888 | enquiry@ippfa.com