Building Your Wealth The Golden Rules

It’s no secret that most people want to enjoy a better quality of life. This, of course, requires having the financial means to do so. That being said, not all rich people are wealthy. To some, being rich is to have lots of money or owning many things. Yet, it’s important to consider that living costs and expenses can erode that wealth away if a continuous stream of income is not in place. This finite pool of money will eventually wear out if no long-term plan to keep your wealth growing.

On the flip side, those who are wealthy are empowered by their control over their finances. Their net worth continues to grow sustainably allowing them to become wealthier over time.

Boost Your Net Worth

When it comes to growing wealth, the early bird that catches the worm. Time and compound interest are your best friends. With time still on your side, take advantage of every minute you have working for you. Understand that your true wealth potential will depend on your cost of living, how you spend money, and most importantly if you have a good plan.

A solid wealth plan will help you achieve the following:

- Build up your retirement

- Build up assets to be passed down for generations

- Give you peace of mind on monthly and annual financial commitments such as school and enrichment fees, mortgages and travel expenses

- Creates multiple streams of income so that you are not reliant on any single stream

A wealth accumulation plan is an investment strategy that can help you increase the value of your investments and net worth over time. The goal of the plan is to take advantage of compounding by investing funds and various assets for the long term.

Five Rules For Your Golden Goose

Rule #1: Pay Yourself 30% First

Warren Buffet once said, “Don’t save what is left after spending, but spend what is left after savings.” Most people are used to making their monthly payments first and only saving what’s left. Why not pay yourself first, even before paying your bills?

Prioritising yourself. This means that once you receive your paycheque, you take a percentage out and send it straight to your savings, retirement or investment account. A good benchmark to start with is by saving 30% of your monthly gross income.

This way, you are prioritising saving or investing for your family’s future before you spend money.

Rule #2: Keep Spending to a Maximum of 70%

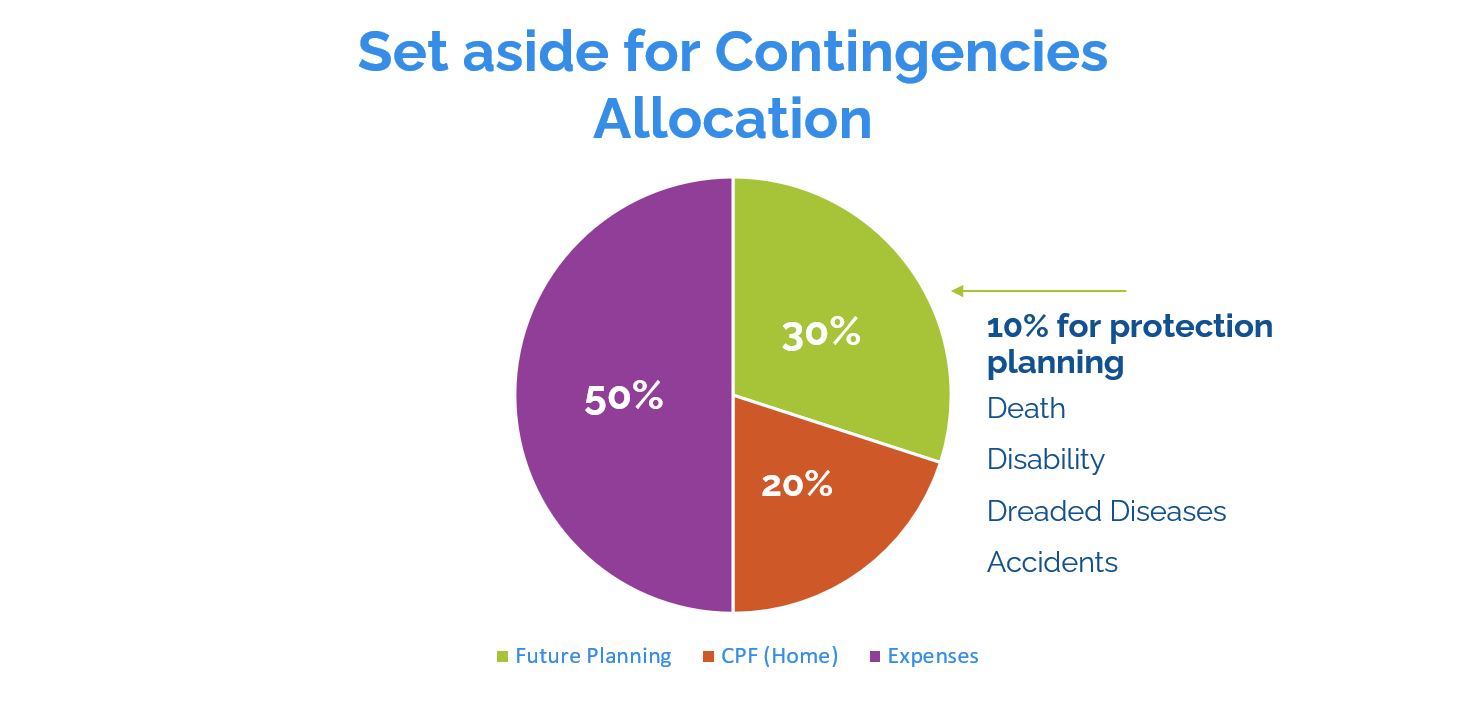

Study how much of your income is coming in and what money is going out. With 30% of your income first going into savings, a common strategy for the remaining amount is to use the 50/20 rule.

This is the idea that you budget 50% of your money towards necessities, utilities, children’s classes, and home loan instalments (using your Central Provident Fund). 20% can then be set aside for lifestyle wants. Of course, you don’t have to spend it all. The more you save, the better your position.

Rule #3: Multiply Your Money

Putting your money in the right places can help it grow substantially over time. With the power of compound interest, it can even double while you sit back and relax.

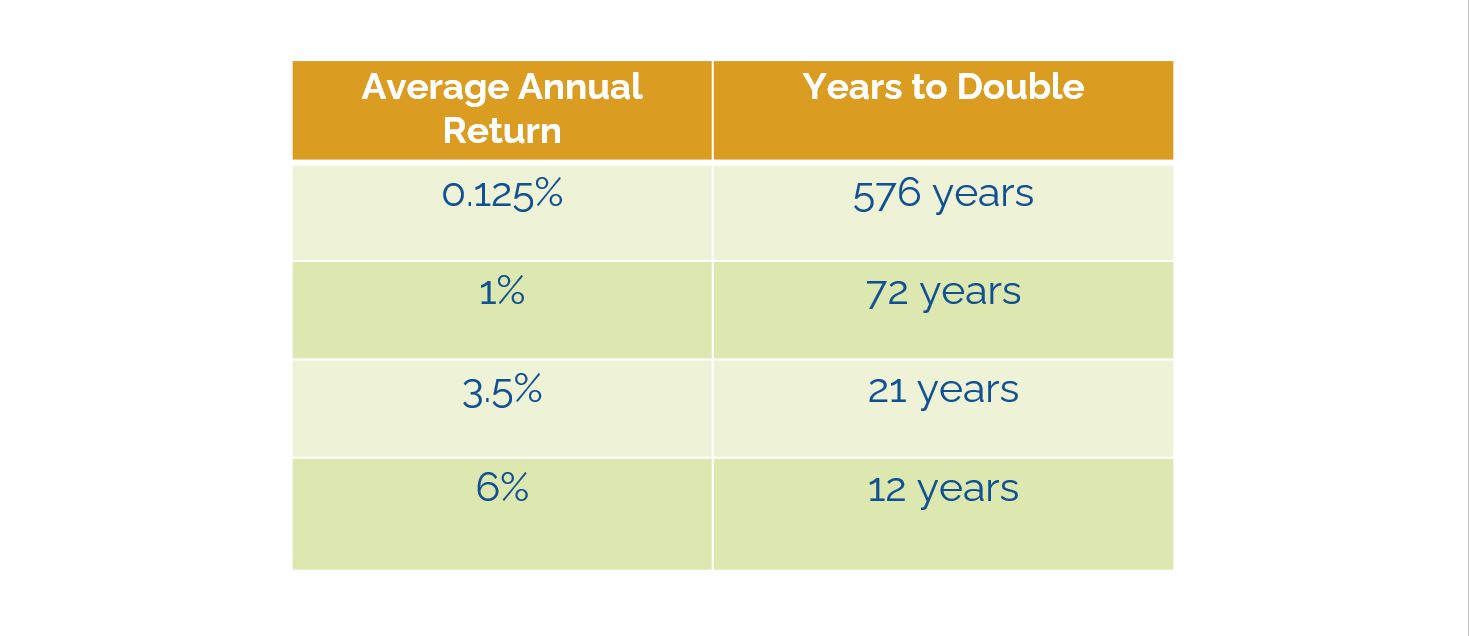

A simple way to find out how fast you can double your investment is to use the Rule of 72. This is an easy computation tool to approximate the number of years it will take for your money to double with a fixed rate of return.

For example, an investment with a 4% annual rate of return will double in 18 years. An investment that pays 6% will take 12 years. By investing just 2% more, you can double your investment six years earlier.

Rule #4: Protect What You’ve Built

While on your path to wealth accumulation, you would need to plug any gaps in the event of unexpected circumstances. Being unprepared can add to immense financial stress.

When you have a sizable amount of assets, you must be insured to protect what you have. You may diversify your portfolio to allow part of your surplus funds to go into options that would maximise your income and protect against risk.

Speaking with a professional licensed and qualified financial professional can help you get the advice you need to protect the money that you’ve worked so hard to save for your retirement and legacy.

Rule #5: Let Your Wealth Take Flight

You’ll need to spread your wings wide to earn more money. When you have accumulated your wealth, you would want to hold that wealth over the long term to provide maximum benefits to you and your family. With your adviser’s help, let your money work harder for you through investment.

As the saying goes, don’t put all your eggs in one basket. A well-diversified portfolio allows you to spread your risk, and this includes investments with a combination of features and returns profiles. An experienced and qualified financial adviser can help you construct a diversified portfolio to minimise risk.

When it comes to investment, people tend to react to changes in the stock market emotionally. A primary benefit of a financial advisor is to help eliminate that emotional decision-making for clients. Have a chat with us and let us help you make the best long-term plan for your money.

Alex Ang, a well sought-after adviser in the financial planning industry, has more than a decade of experience in helping people achieve their financial goals. As a dedicated adviser, he has built an extensive network of long-term clients who appreciate his impeccable service and advice.

Based on his outstanding performance, Alex has received numerous awards such as the IPP Chairman’s Round Table and the IPP-APEX Top Adviser. He is also consistently ranked as one of the top 10 advisers in IPP since 2014.

Recognised for his leadership skills, Alex is known to be selfless as a mentor to his team and new advisers. Under his tutelage, these advisers too have achieved success within a short timeframe. Described as a kind and passionate leader, Alex is proficient in customising the learning program according to each of his mentee’s personality. By identifying their talents, he guides them patiently on how to utilise their skills to flourish in the industry. With numerous accolades under his belt, Alex’s next goal is to nurture the next generation of leaders in the financial planning industry.

Contact Alex Ang at:

Corporate E-mail:

alexang@ippfa.com

IPP Financial Advisers Pte Ltd

78 Shenton Way #30-01 Singapore 079120 | Tel: +65 6511 8888 | enquiry@ippfa.com |

IPP Financial Advisers Pte Ltd

78 Shenton Way #30-01 Singapore 079120

Tel: +65 6511 8888 | enquiry@ippfa.com