After years of go-getting hard work, your retirement should be a time of freedom and choice. However, in reality, retirement takes a considerable amount of preparation to be planned well. By taking a personalised approach for your retirement plans, you can potentially stretch your income and allow your money to work harder without you having to be in the workforce for longer than you want to be.

Step 1: Be like an Athlete – Visualise your Dream

Visualisation techniques are an important part of an athletes’ sporting careers, whereby successful outcomes are envisioned. Since the 1960s, this technique has also proven successful for peak performers outside of professional sports.

This practice works perfectly for retirement planning as well. Rather than calculating numbers or looking at charts, when you visualise your later years in a detailed, positive way, it can become a motivator for financial savings.

Here are some examples of retirement visualisations:

A) The Jetsetter

You dream of exploring the world after achieving all your career goals and envision travelling up to three times a year with the free time you have on hand after retirement.

B) The Happy-Go-Lucky Grandparent

You wish to retire comfortably and at a sustainable pace, whilst ensuring that your basic needs as well as your spouse’s are covered. At the same time, you also hope to plan family outings and dine out from time to time.

C) The Lifelong Learner

With all the spare time you have now in retirement, you hope to be able to pick up all those hobbies that you have left on the backburner.

Through thoughtful conversations, a good financial adviser representative will develop a process to help you flesh out the details of your vision. This process includes prioritising what is important to you, your values, and what you would like to do after retirement.

Step 2: Understand your retirement needs

After visualising, an essential step is to identify your daily spending goals and work out your long-term cash flow needs. To work this out, it can be helpful to think about your expenditure in terms of two distinct categories: needs and wants.

What are needs?

• Needs are things that you cannot live without: food, shelter, water, healthcare and medications, medical emergencies, clothing.

• Needs are fixed expenses that you will be required to pay for throughout your retirement.

• You may want to use stable, fixed income sources to cover your needs.

What are wants?

• Wants are everything else you do not require to survive.

• Wants include: video-on-demand subscriptions, mobile phone plans, a luxury car, overseas vacations.

• Your wants and when you want them will play a key role in your retirement portfolio choice and how much risk you want to take with your savings.

Take for instance, a typical profile of a Singaporean man named Percy. Let’s find out how much funds he would need to retire comfortably.

How Much Will Percy Need?

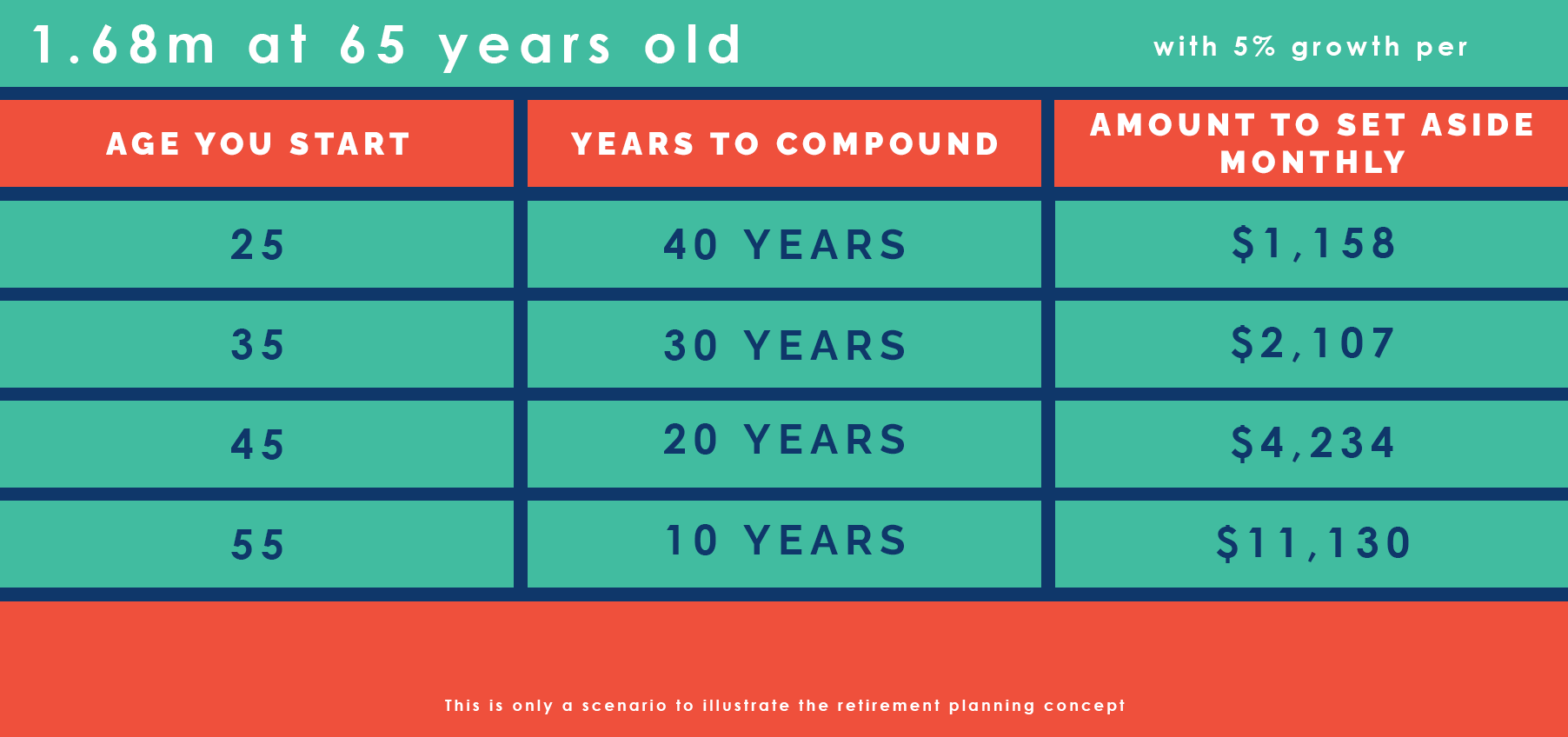

Percy is 35 years old. He wishes to retire at age 65. Based on today’s currency rates, Percy desires a monthly retirement income of $3,000.

Considering a life expectancy of 85 years and an inflation rate of 3%, to retire at 65, Percy will require:

• A fully paid-up house

• A nest egg of $1.68 million

After inflation, Percy will need a monthly income of $7,000 once he retires.

Step 3: 3 Retirement pitfalls you must avoid

Pitfall A: Starting Late

>Many people take for granted that retirement is still a long way ahead and give many reasons why planning cannot start, no matter their age.

|

20s |

30s |

40s |

50s |

60s |

|

“I just started working, and I don’t have a stable income.” |

“I am preparing for my wedding and my new home.” |

“I am facing a mid-life crisis, and my employment is not secure.” |

“I need to pay for my children’s education, and I am facing job insecurity.” |

“It’s too late. I have no more excuses.” |

Avoid this same mistake. In reality, every passing day counts towards building your nest egg. Take a look at this example below. When you start saving earlier, you will only need to set aside a small amount every month as opposed to when you start later.

Pitfall B: Betting on a Windfall

With the markets being extremely volatile, putting all your eggs in one basket and hoping that they give you massive returns is essentially as good as betting on a windfall.

Don’t rely on events that you cannot control, including counting on a particular return on investment or hoping to win the lottery. In addition, overreacting to market volatility may prove costly especially when you focus resources on just one aspect of investment.

With the help of a financial adviser representative, you can develop a sound savings and investment strategy to suit your risk profile. For instance, how much risks you are exposed to will determine the level of risk management that can give you the best odds of achieving your goal in a manner that gives you peace of mind.

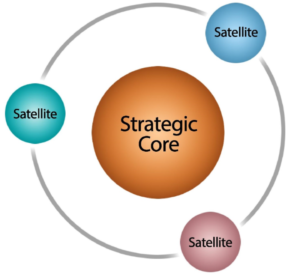

A Systematic Strategy: Core and Satellite Approach

The combined core and satellite investment approach allows you to enjoy the best of both worlds.

Core investments provide stability and long-term appreciation. With exposure to the broader market, it helps spread your risk around so that any poorly performing investments will not impact your portfolio too severely.

Satellite investments take up a smaller portion of the portfolio. However, it has a higher level of risk with returns that can push up your overall returns.

Step 4: Your game plan

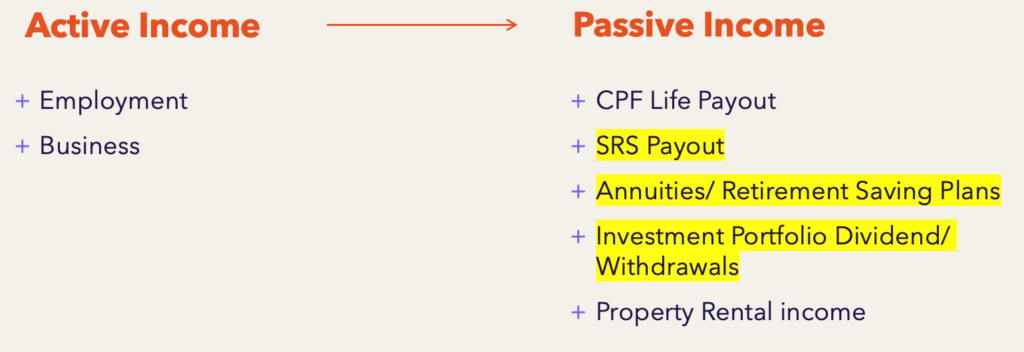

While it usually takes money and effort to make even more money, you can turn your active income to build sources of passive income with careful planning. A solid passive income strategy allows you to make money long after retiring and potentially have enough to pay for all your needs without putting much extra effort.

Passive Income Possibilities in Singapore

Depending on your risk appetite, you may put your money into various forms of investments:

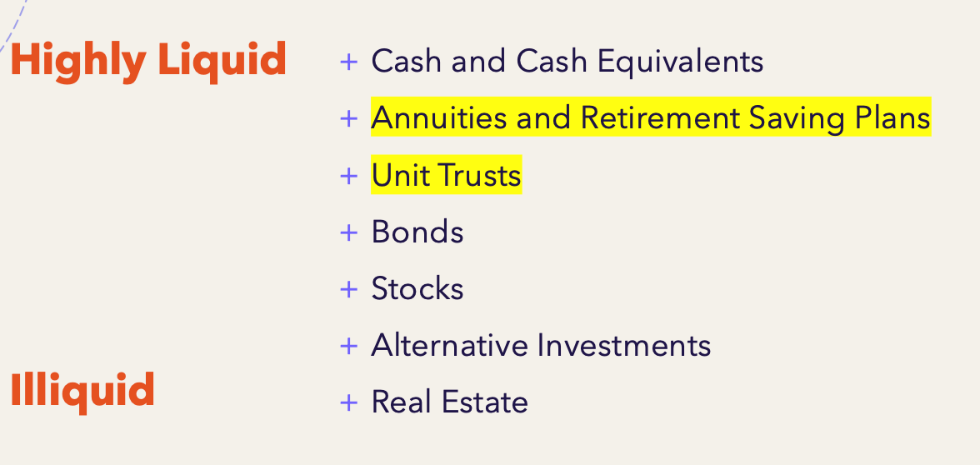

In an ideal scenario, target a retirement portfolio that can go the distance:

• High and stable passive income

• Low-risk and diversified

• Liquid and flexible

• Offers generational wealth transfer

Our Recommendation

In an ideal scenario, a retirement portfolio would have the following features:

Better Crisis Management

• Enjoy guaranteed income no matter the economic climate – this will ensure that you remain assured in spite of the economic climate

Your retirement planning strategy will play a significant role in how you can enjoy your eventual retirement years. This involves negotiating a balance between your goals and the expenses that you may incur. A financial adviser representative can help you understand the complexities of the many products and services that are available today.

By making intelligent choices early to leverage the effect of compounding fully, you will be well on your way to a comfortable and independent retirement.

APEX ADVISORY GROUP

Genevieve Shee

Genevieve Shee has had over a decade of experience as a financial services professional. The capable consultant supports an extensive network of 500 clients, of whom, many values her professionalism and candour. Her passion burns the brightest when it comes to helping young families, as the young mother herself is acutely aware of the hardships besetting them. Genevieve is known to be a capable planner with a good eye for holistic strategic planning, her competency has won her a broad array of clients from different demographics, ranging from mass-market to high-wet-worth individuals and everything in-between. Having achieved Chfc certification since 2013, Genevieve has been consistently in the top 50 performing Advisers at IPP. The MDRT consultant shows no sign of slowing down as she continues to strive forward with enthusiasm and aplomb.

IPP Financial Advisers Pte Ltd

78 Shenton Way #30-01 Singapore 079120 | Tel: +65 6511 8888 | enquiry@ippfa.com |

IPP Financial Advisers Pte Ltd

78 Shenton Way #30-01 Singapore 079120

Tel: +65 6511 8888 | enquiry@ippfa.com