A client of mine was interested in a mutual fund investing in Asian equities. It had a great investment track record and a solid manager; his main reservation was that it was denominated in British pounds (GBP). Given the continuing fallout from Brexit, he was afraid that GBP would depreciate in value against the Singapore Dollar (SGD) and therefore he could lose money in SGD terms even if the fund performed well.

Is he right to be concerned?

The answer, which might be surprising to many, is that the fund has no GBP exposure, even though it is denominated in GBP. Instead, its exposure would have been to the currencies of the underlying assets – that is, the Asian equities that the fund is buying.

This is an important concept to understand because currency exposure can make a big difference in investment returns. For example, let’s say I had S$1000 invested in the UK stock market index ETF, denominated in GBP. During Brexit, GBP plunged in value from 2 SGD to about 1.8 SGD in less than a week. This would have resulted in a painful 10% loss for my position due to currency depreciation. In this case, I was exposed to GBP depreciating against the SGD, and was punished for it. (see Fig.1a )

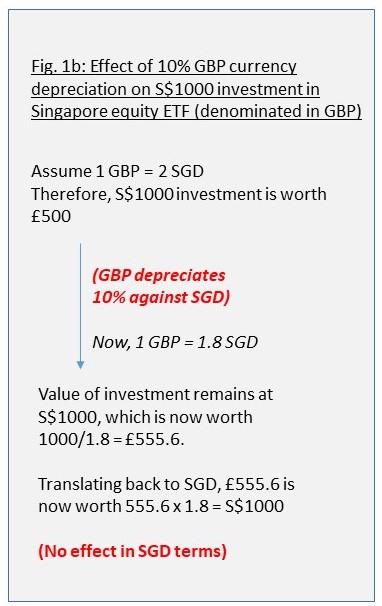

But what if, instead of the UK stock market index, my S$1000 was invested in the Singapore stock index, but denominated in GBP (let’s just assume such an ETF exists on the London Stock Exchange)? Then, when GBP drops from 2 SGD to 1.8 SGD, my Singapore stocks would have gone up in value in GBP terms. This gain would exactly counteract the currency loss, resulting in a net effect of exactly zero – my S$1000 investment still remains valued at S$1000 (see Fig.1b)

Take a step back from the numbers for a bit and you will see that this makes intuitive sense. As a Singapore-based investor, invested in Singapore equities, it doesn’t matter whether I express the value of my Singapore investment in pounds, euros or US dollars. My S$1000 still remains S$1000 no matter how the other currencies move; my currency exposure is only to the underlying asset currency, which is SGD.

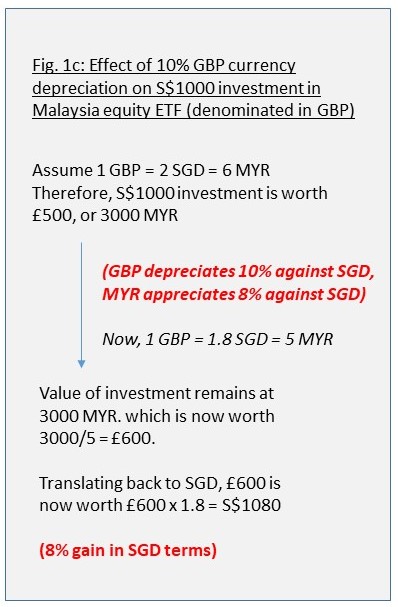

Similarly, if the S$1000 was invested in Malaysian equities, it doesn’t matter whether the value of these equities is in a fund that is denominated in pounds, euros or any other currency. What matters is only how the underlying asset currency – the Malaysian ringgit – moves against the Singapore dollar (see Fig. 1c).

This result has important implications for investors in mutual funds and ETFs. For example, the Singapore stock exchange has many ETFs that are denominated in USD. The DB x-trackers MSCI Europe ETF is denominated in USD but your exchange rate risk is EUR/SGD. The iShares MSCI India is also a USD ETF but the underlying exposure is to the Indian Rupee. So one can safely invest in these without worrying about potential exposure appreciation or depreciation of the US dollar against the Singapore dollar (although one is always still exposed to the underlying asset currency).

Less obviously, but just as importantly, one has to be very careful when dealing with hedged share classes of mutual funds. A hedged share class only protects against currency exposures if the underlying asset currency is the same as the fund currency. For example, according to its factsheet, the Nikko AM Japan Dividend Equity fund invests in Japanese equities and is denominated in Japanese Yen (JPY). In this case, because the underlying exposure is JPY/SGD, a SGD-hedged share class would shield a Singapore-based investor from currency exposure since the hedge protects against JPY/SGD movements.

But a hedged share class cannot fully protect against currency exposure if the underlying asset currency is different from the fund currency. Consider a China equity fund denominated in USD. Since the underlying asset is Chinese equities, the unhedged share class is exposed to movements between SGD and the Chinese Yuan (CNY). Even if the fund has an SGD-hedged share class, the hedge would be between SGD/USD, not SGD/CNY. The result of the mismatch between the hedge and the actual exposure is that the SGD-hedged share class still has a currency exposure, but it is to USD/CNY movements, which is likely not what is intended by most investors.

Also, even if it were possible to hedge away currency exposure, it might not be desirable to do so. For export-oriented economies such as Japan or the USA, currencies often move in opposite directions to the stock market in the short term – currency appreciation tends to decrease the competitiveness of the nation’s exporters and drives stock prices down, and vice versa. Hedging away the counterbalancing effect of currency movement could therefore potentially result in greater volatility. Hedging also incurs costs that end up getting charged to the hedged share class, potentially reducing investment returns.

In general, when investing in international equities, it is always good to be aware of what your currency exposure is, but my preference is to leave exposures unhedged unless I had a very strong view on the underlying currency exposure or there was a potential market dislocation (such as an important election) on the horizon that needs to be protected against.

INSPIRE ADVISORY GROUP

Herbert Lian

A keen specialist known for his rigorous and impeccable analytical skills, Herbert Lian is a professional through and through. The immensely foccused and driven consultant has excelled in many notable areas of pursuit, including academics. Notably, this includes completing his Master of Science, at Stanford University and Bachelor’s Degree at the University of Chicago, both with a perfect GPA. In addition to his professional and academic achievements, Herbert is also an accomplished writer with a regular column with The Edge since 2016.

Today, he continues to serve professionals in both the private and public sectors, helping them grow and safeguard their wealth.

Contact Herbert Lian at:

Corporate E-mail:

herbertl@ippfa.com

Herbert Lian is a Financial Advisory Representative at IPP Financial Advisers. The views expressed here are solely those of the author in his private capacity. This article should not be regarded as professional investment advice or as a recommendation regarding any particular investment.

IPP Financial Advisers Pte Ltd

78 Shenton Way #30-01 Singapore 079120 | Tel: +65 6511 8888 | enquiry@ippfa.com |

IPP Financial Advisers Pte Ltd

78 Shenton Way #30-01 Singapore 079120

Tel: +65 6511 8888 | enquiry@ippfa.com