Understanding Scams: 3 Red Flags To Look Out For

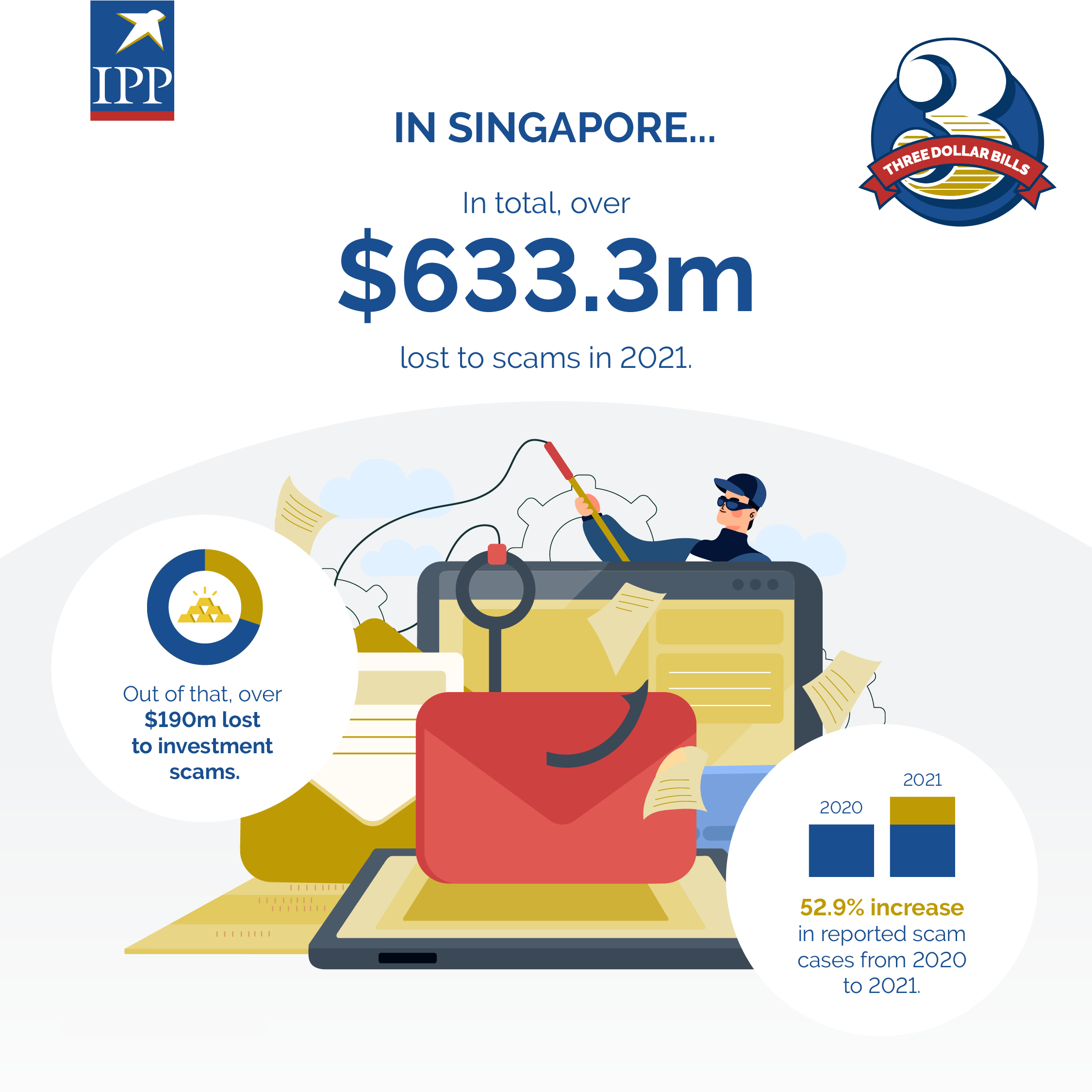

Reports of scams are on the rise, with Singaporeans losing over $190 million to investment scams alone in 2021, according to Statista. People from a variety of backgrounds have fallen prey to scams, from the everyday man to even lawyers and fund managers . Today we look at the red flags you might encounter in some of the most common types of investment scams.

Too Good to be True?

The first and biggest red flag is also the simplest: the offer is simply too good to be true. Freebies, guaranteed returns, high interests – these are all very attractive, and why scammers continue to use them to lure victims in.

Guaranteed earnings

- While some financial products do offer guaranteed returns, they typically come with low interest rates or strings attached. If someone is advertising guaranteed year-on-year returns indefinitely, this may be a sign that something isn’t right.

High returns

- In conjunction with the first point, scammers usually increase the attractiveness of their “products” or “services” by not only touting the idea of guaranteed returns, but guaranteed returns with returns on investment that are much, much higher than average. Have you ever seen a product offer $10,000 in returns, with a starting investment of just $500? Scammers often throw out large numbers to entice investors, who may not be able to differentiate between “a really good deal” and “too good to be true”.

Low-risk investments

- The old adages of “high risk, high return” and “no pain, no gain” are true of any investment. While not all scammers will make the claim of “guaranteed returns” up front, if they are downplaying or avoiding conversation about the risks involved, it may be a sign for you to back away.

Giveaways

- One type of cryptocurrency scam that can be found on social media involves the promise of a giveaway, and all one has to do to claim the reward is deposit some cryptocurrency into the stated account. Once the transaction is completed, the scammer disappears, and the coins can be almost impossible to recover. Just as with the above points, if something sounds too good to be true, it probably is.

Pressure, Pressure, Pressure

The second red flag to look out for is high-pressure sales tactics. Claims such as “I have many other interested investors lined up if you aren’t interested” are a common refrain, and scammers use them to pressure investors into handing their money over. A scammer might also try to convince you that the offer they have is time sensitive, as the product has a limited-time offer or they have “insider information” that the price of a certain stock is going to rise in the next few hours. These statements are all designed to have the investor make a decision as quickly as possible, without the time to slow down and think the decision through properly. The scammer might also discourage you from trying to do your own external research, or to consult a second opinion.

Who Am I?

The third red flag to look out for is a lack of identification. Scammers are growing savvier, setting up websites that look increasingly legitimate, and even the most discerning investor may have difficulty telling the real from the fake apart. If you are unable to find information about the product or the company in question outside their “official” social media accounts or website, you should be on your guard. If you’d like to verify someone’s identity for yourself, you can find the lists of individuals and institutions licensed by the Monetary Authority of Singapore (MAS) on the MAS website, although not all financial activities require an MAS licence.

Conclusion

The next time you come across a good investment deal, remember to check these things: Does the offer sound too good to be true? Are you being pressured to make a snap decision? Can you confirm the broker’s identity? When in doubt, it’s always a good idea to do your own research before making a decision.

“This advertisement has not been reviewed by the Monetary Authority of Singapore”

Disclaimer: Investments have investment risk. Past performance is not necessarily indicative of the future performance of an investment. Please seek advice from a Financial Adviser Representative before making any investment decisions.

IPP Financial Advisers Pte Ltd

78 Shenton Way #30-01 Singapore 079120 | Tel: +65 6511 8888 | enquiry@ippfa.com |

IPP Financial Advisers Pte Ltd

78 Shenton Way #30-01 Singapore 079120

Tel: +65 6511 8888 | enquiry@ippfa.com