Why It Is Essential To Invest

Being self-sufficient gives you the freedom to do more and to enjoy life. Self-sufficiency means having the ability to provide for yourself without relying on someone else or working in your old age. No matter your career stage, the time to begin building your wealth is now.

Limitations Versus Possibilities

You may be trying to manage a budget and committed to monthly payments. Adding a financial task such as an investment can be daunting, but this could be your most important task of all.

When you invest, you take charge of your financial security. It allows you to generate an additional income stream ahead of your retirement to pursue the lifestyle you want so that it becomes one of possibilities rather than a limitation.

Make an Informed Decision

After working hard for your money, it’s time for your money to work hard for you. However, the onus is on you to put your money to work. Let’s look at the facts of life today to see when you should begin investing.

- Life expectancy is at its highest

Singaporeans are living longer than ever before. Avoid the mistake of underestimating life expectancy and the number of years you are likely to spend in retirement. In 2010, life expectancy in Singapore was 81.7 years, and increased to 83.9 years in 2020[1].

- Your money will devalue with inflation

With the rise in the cost of living over time, inflation can impact your financial wellbeing.

- Central Provident Fund (CPF) savings may be insufficient

Three out of four Singaporeans expect a higher pay-out than any CPF scheme can offer during retirement. According to a survey[2], the current average retirement savings among pre-retirees is $423,000. However, most respondents indicated that they require $1.1 million to retire comfortably, a retirement savings gap of $677,000.

- Your health status and healthcare spending will change over time

In line with a longer lifespan and healthcare needs with age, healthcare costs will likely increase during your retirement years, and you need to plan for that.

- Financing and taking care of loved ones

Your plans aside, you will have to factor in your spouse’s, children and parents who may rely on you for financial support. These include financing your children’s university fees and caregiving costs for your elderly parents.

Take Full Control of Your Wealth

To find out the optimal way to grow your wealth, you will need to understand these three income types:

Most individuals belong to the active income segment, where they spend time working for money in return. As an investor, however, you can enjoy passive income with little active participation. Investments such as stocks, bonds, and real estate can generate long-term cash flow for retirement.

The Real Cost of Delay

There are many reasons for holding off investing. Some feel they do not have enough to start investing, and some are wary of making a wrong investment decision.

The reality is that simply leaving your money in the bank can cost you a fortune. While you might be earning 2 to 4% in interest in your savings account, this amount earned can be wiped away by inflation.

The Power of Compounding Interest

When invested, our savings have the power to grow exponentially. While it might begin slowly, it is a cycle that can allow wealth to rapidly snowball because not only are you earning interest on your initial investment, you are also getting interest on top of interest.

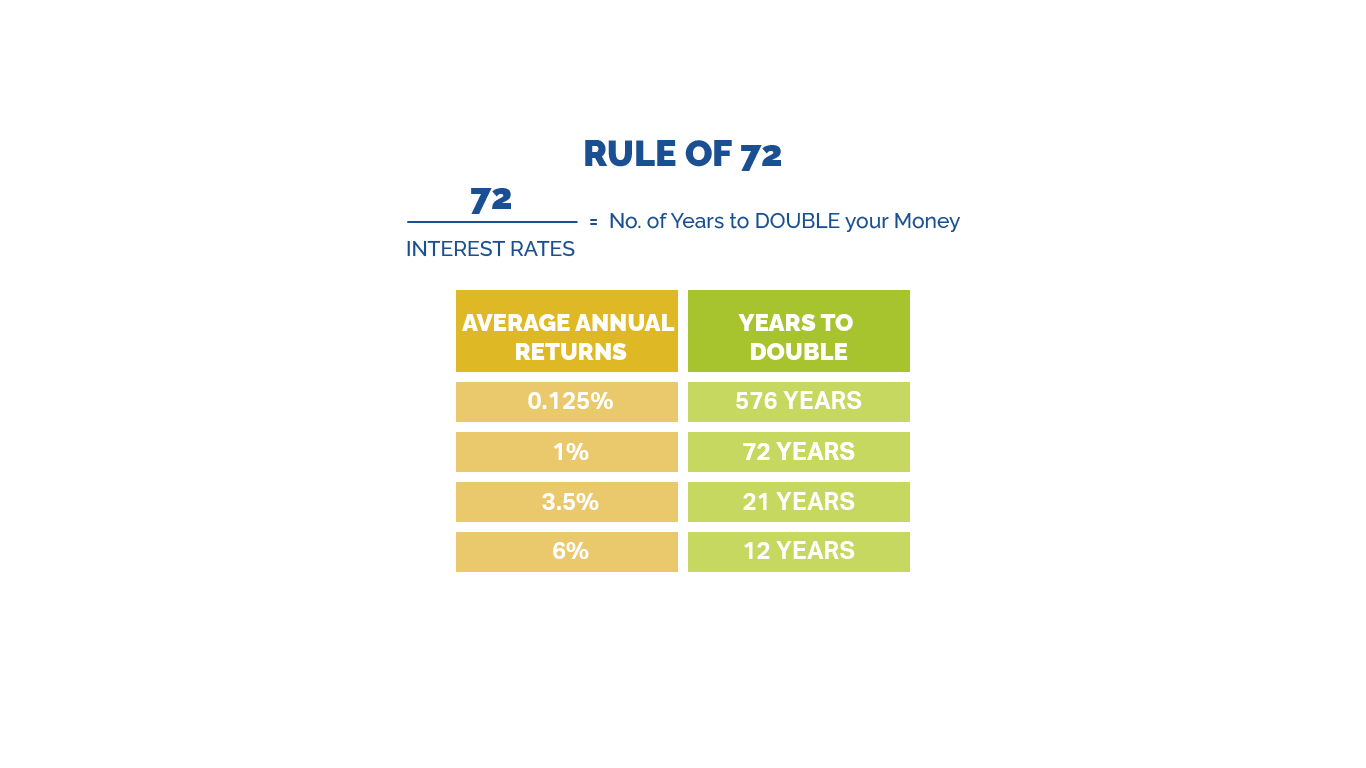

With the Rule of 72, you can calculate how long it will take to double your money at an expected rate of return.

For example, an investment with a 3.5% annual rate of return will double in 21 years. An investment that pays 6% will take 12 years. With just an additional 2.5%, your investment easily doubles nine years earlier.

Attain Investment Know-how

All investments are different. They can be complex and require you to make many decisions from the many available options. To begin investing, you can start simple, or you may seek advice from an experienced financial adviser.

To begin, here are some essential elements to investing:

Understanding Diversification

Asset allocation is the act of spreading your money across a range of assets to reduce investment risk. The key to intelligent investing is also called portfolio diversification.

A diversified portfolio allows your overall investments to absorb any shocks from financial disruption in the long term. It will enable high-return investments by offsetting possible risks with more stable alternatives.

These risks include:

- Geographical risk

- Sector risk

- Currency risk

Investing in different industries, regions, and currencies will give you the best balance for your portfolio.

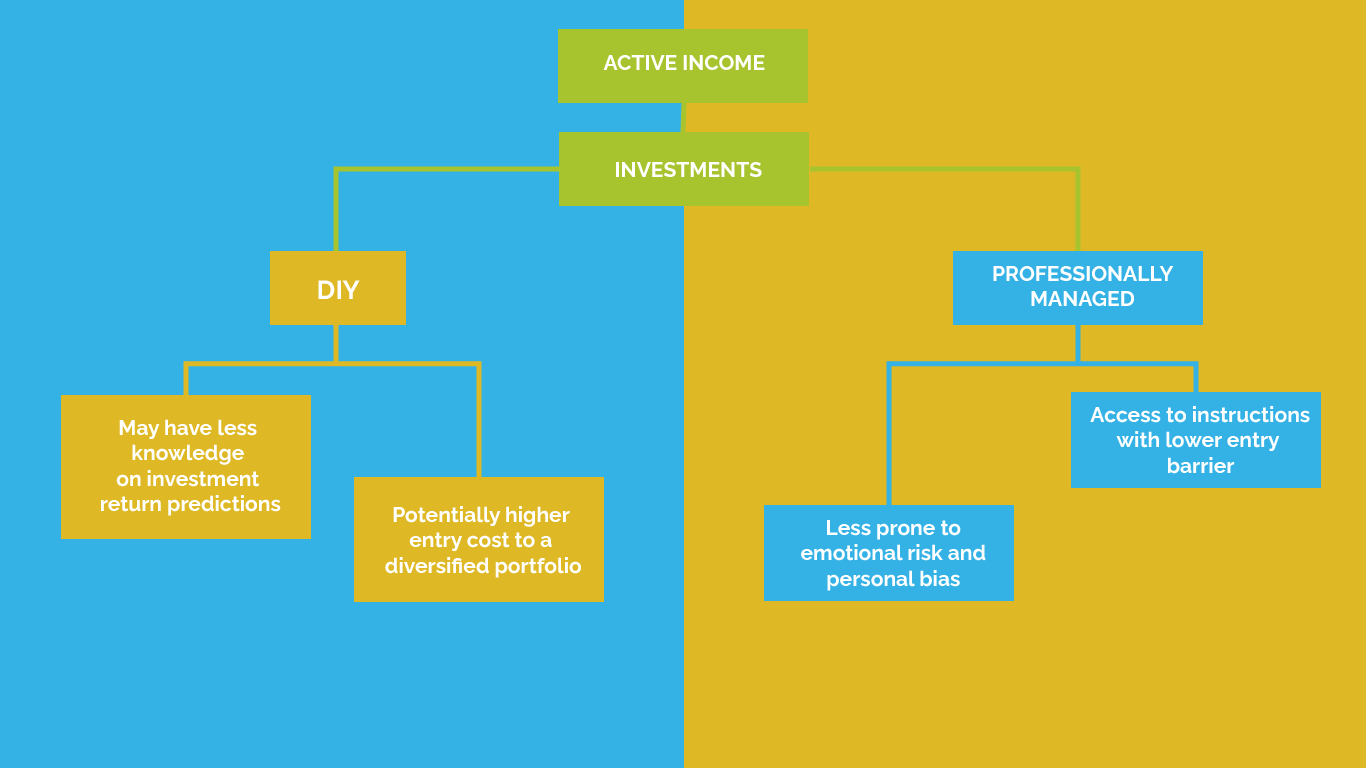

Do-it-Yourself Investments or Professional-managed Investments?

With plenty of information available online, you might feel equipped to manage your investments on your own. However, to be most effective, you would need time, interest and discipline. In addition, money comes with a significant emotional component[3] , and you may end up playing to emotional investing based on suboptimal decisions.

In our experience, encouraging people to self-manage their investments is like encouraging homeowners to fix their own plumbing. While some can do so, a majority of people will achieve a better outcome by hiring a skilled plumber with the necessary know-how and tools.

A good financial adviser will use data and research to recommend investments based on their performance for holistic benefits. You will be able to tap on the adviser’s knowledge and resources as they monitor the markets and stay on top of news, products and events. Not only do they save you time from having to keep track, the adviser’s role is to ultimately help you reach your long-term goals.

Knowing Your Risks

Whether you are managing your investments or getting professional assistance, investment risk comes in many forms, and it can affect how you pursue your financial goals. A professional financial adviser can help you correctly identify opportunities that are suited to your risk profile.

Depending on your age, you can afford to be riskier if you are younger to increase your chances of earning higher returns. As you head towards retirement, being conservative with your investments would be a more prudent approach.

Consult a financial adviser who will be able to assess your risk tolerance to begin your investment journey so that you can enjoy its potential rewards.

APEX ADVISORY GROUP

Mervyn Ang

An advocate for upward economic mobility, Mervyn is passionate about helping people improve their economic statuses.

A specialist in investment planning, Mervyn supports about 200 clients in growing their wealth, legacy planning, and facilitating buy/sell agreements. His determination to help others was influenced by a personal experience earlier in life, where he lost a small fortune due to unsound advice. He took the loss in his stride, and strengthened his resolve to focus on strategic advice and good planning in personal finances.

Today, he continues to strive to make a difference in his clients’ lives – so that they can as he puts it, do what they love in life.

Contact Mervyn Ang at:

Corporate E-mail:

mervynang@ippfa.com

[1] Complete Life Tables for Singapore Resident Population, 2019-2020

(https://www.singstat.gov.sg/-/media/files/publications/population/lifetable19-20.pdf)

[2] 2 in 3 Singaporean retirees regret not planning earlier for retirement

(https://www.manulife.com.sg/en/about-us/newsroom/2-in-3- singaporean-retirees-regret-not-planning-earlier-for-retirement.html)

[3] The Effect of Money on Your Emotions (https://www.spsp.org/news-center/blog/effect-money-your-emotions)

IPP Financial Advisers Pte Ltd

78 Shenton Way #30-01 Singapore 079120 | Tel: +65 6511 8888 | enquiry@ippfa.com |

IPP Financial Advisers Pte Ltd

78 Shenton Way #30-01 Singapore 079120

Tel: +65 6511 8888 | enquiry@ippfa.com